Thinking Ahead: Making Sense of the Disconnect between Markets and the Economy

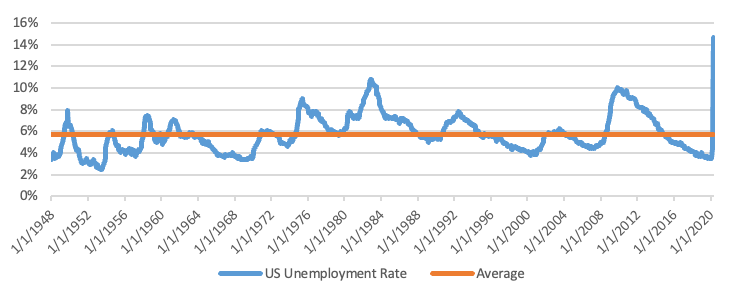

On May 8th, the Bureau of Labor Statistics released its monthly data on the US unemployment rate which jumped from 4.4% to 14.7%, the highest level since the Great Depression. That same day, the S&P 500 Index was up +1.7% after rising +12.8% in April, the month the data covered.

Figure 1: US Unemployment Rate vs. Long-term Average

Markets are naturally full of surprises, so at face value this is nothing new for investors. But the speed at which stocks approach their pre-crisis highs amidst the sharpest economic downturn of the post-war era has led many to question this trajectory. With such a powerful disruption across the globe, how can the rebound in financial assets fit with economic reality?

There are no clear historical parallels to answer this question – as Federal Reserve Chairman Jay Powell explained in his May 13th speech, “the scope and speed of this downturn are without modern precedent.” But beneath the surface of markets and the economy, both longstanding forces and new dynamics can offer insight into what is happening.

Markets are Looking Ahead (into the Unknown)

Starting with what is familiar, the forward-looking nature of markets has been clear in recent weeks, as people look ahead to a new normal even if they are unsure of what it will be. By investing we are effectively purchasing future cash flows which gives markets the ability to absorb short-term shocks provided there are expectations of an eventual recovery.

Investors are thus recognizing the value in those future cash flows versus other investable assets, such as US Treasuries where 30-year yields close in on record lows. While risks have increased substantially due to the pandemic and its economic impact, this is already reflected in asset prices. Markets will recalibrate – as they always do – to a new set of conditions moving forward.

Existing Trends are Accelerating

For companies, the shutdown’s impact has not been uniform, and important differences will flow through to future financial results. Many large firms that make up indices like the S&P 500 have continued to use advantages of scale and greater financial strength to weather this disruption. They are now positioned to gain market share from smaller competitors under pressure.

While the pandemic may have hit firms at roughly the same time, it has taken trends that were already in place – like consolidation, e-commerce and the dominance of technology – and accelerated these dynamics as we emerge from the crisis.

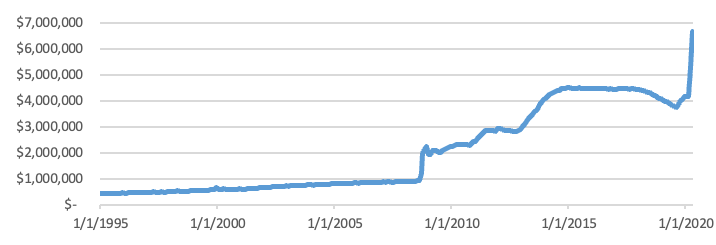

The Fed is the Biggest Factor

The phrase “don’t fight the Fed” has been around for decades but continues to grow in importance alongside the size of the central bank’s balance sheet. The institution’s role in markets has evolved due to the limits of traditional monetary policy, and its expanding toolkit is clearly evidenced by large-scale asset purchases reaching unprecedented levels.

Figure 2: Federal Reserve Total Assets (millions of $)

The Fed balance sheet is a growing factor in markets that can produce an artificial straddle on the news. Improving data on containing the virus has logically driven markets higher, but downside surprises have also been stimulative based on expectations of the Fed buying more assets in response. This type of market intervention can be risky, particularly when it comes to moral hazard, but it’s a key factor in asset prices as the Fed endeavors to support the financial system.

What will the impact of all of this be? With something as unpredictable as a virus, the set of potential outcomes is wider than it has been in the past. Additional waves of the illness are certainly possible – along with unforeseen knock-on-effects – and fitful stops and starts could create further challenges for businesses.

Beyond the pandemic’s devastating toll on human life and extraordinary disruption, it will also leave behind enormous costs in dollar terms. Attempting to bridge the unprecedented gap in economic activity has already cost trillions, and further stimulus packages may still be on the horizon. Determining how economic support measures are paid for will not happen overnight, and this is likely to be a key issue in markets – and more broadly, society – for years to come.

Despite these headwinds and unfamiliar challenges, it is important to remember the economy is built to adapt. As businesses reopen and people get back to work, new ideas and innovation will play a key role in the recovery. While the path ahead may be uncertain, the foundation for growth remains, and the time-tested, all-powerful engine of human ingenuity will ultimately drive us forward to a new economy.

***